- Car finance calculator based on credit score how to#

- Car finance calculator based on credit score free#

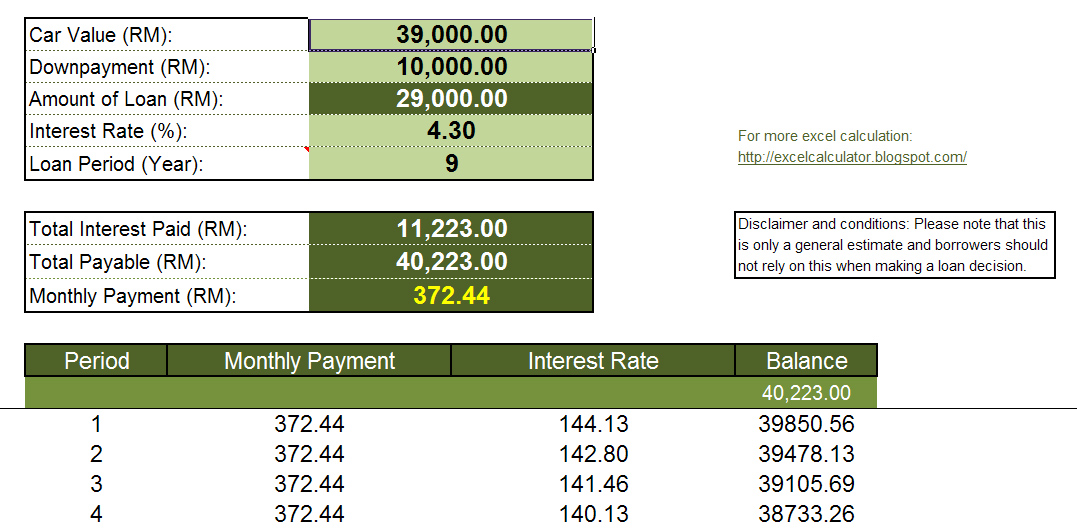

It is possible to change the arithmetic of a lower credit score by increasing your down payment, financing for fewer months or delaying your purchase until you can boost your score. So what can the nonprime or subprime borrower do to narrow the gap? Changing the arithmetic (Interest rates frequently change and currently are slightly higher at all credit levels than the examples, which were based on Experian data from December 2019.)

Using our example interest rates above, payments from high to low would be $466, $418 and $377, respectively, a savings of more or less $50 per month. Meanwhile, a prime customer (661-780) could get a 5.97% rate on average and pay $3,103 interest total, or about $2,452 less than the nonprime borrower and a whopping $5,900 less than the subprime borrower, based on Experian data and a calculator.īecause a better credit score may result in a better interest rate, it typically would result in a lower monthly payment as well with all other factors in the transaction – car price, down payment and financing term – remaining the same.

Car finance calculator based on credit score how to#

How to shop smarter, smooth out financing for your next car

Car finance calculator based on credit score free#

Why your free credit score may be more important than ever How to use an auto finance calculator: A step-by-step guide household median $75,000 and making no other vehicle payments.īut a subprime borrower (501-600 credit score), would get the funds at 16.14% interest on average, with total interest payments of $9,039, or almost $3,500 more over 60 months. That monthly payment is steeper than the average used-vehicle payment but still would be within the limit of 20% of annual income suggested by most financial experts, assuming you are earning the U.S. Purchasing a used vehicle for $22,000 with a $2,500 down payment and financing for 60 months would result in monthly payments of $418 and total interest payments of $5,555 over the five-year term. The average nonprime borrower, with a 601-660 credit score, could borrow money for a vehicle purchase at 10.34% interest on average for a used vehicle, according to recent data from Experian. That could be the difference between lower and higher credit scores when financing a vehicle, based on an interest-rate calculator at and data reported by Experian.

0 kommentar(er)

0 kommentar(er)